guiding financial institutions since 2006

Discover Inspiring Voices For Your Next Event

Transform Your Event

Meet Our Esteemed Keynote Speakers

Anne Schutt, CFP®

Vice President of Business Development

Anne is a dynamic keynote speaker who inspires audiences on leadership, motivation, women in banking, and investment program growth, empowering professionals to lead with purpose and achieve lasting impact.

Michael Graham, CFP®

President

Mike is a seasoned professional with over 30 years of experience in community banking and wealth management, offering insights on strategic planning, institutional leadership, and strengthening community-focused financial organizations.

Jim Motteler

Vice President of Relationship Management

Jim is an engaging speaker who focuses on cross-department collaboration, sales growth, advisor coaching, and elevating customer service. He is highly experienced in delivering our Benefit Builder presentation to institution employees.

Presentation Library

Midwestern Securities is an independent broker/dealer and RIA focused on helping community financial institutions grow their non-interest income through a compliant investment services division. We take a consultative approach with all our financial institution partners with the goal of helping them plan for and achieve strategic growth across their institution. To aid in our mission to support community financial institutions, we’ve created a library of presentations aimed at helping bank and credit union leaders grow their enterprise value through the implementation of inspiring and thought-provoking ideas. Contact our team for more information on the topics below.

Optimizing Your Retail Investment Program to Reduce Deposit Outflow

Target Audience: President, CEO, CFO, Directors, Financial Advisors and business development professionals looking to strengthen customer loyalty and capture more wallet share.

Optimize Your Team for Top Performance

Target Audience: President, CEO, CFO, Directors, Financial Advisors

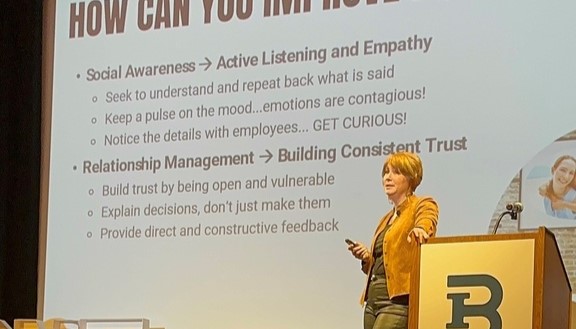

Emotionally-Intelligent Leadership

Target Audience: Institution Leadership, President, CEO, HR Directors, Branch Managers

Seeing Around Corners: Building Strategic Foresight in Community Banking

Target Audience: President, CEO, CFO, Directors, Financial Advisors

Building a Competitive, Scalable Wealth Management Program

Target Audience: President, CEO, CFO, Directors, Financial Advisors

Developing a Change Mindset

Target Audience: Institution Leadership, President, CEO, Directors, Marketing Directors

Serving Business Clients Through Managing Employer Retirement Plans

become less sticky. Supporting these clients at a higher level by managing their employer-sponsored retirement plans through your retail investment services division can help them and their employees be more successful and deepen your connection with them. You can also learn how moving your own retirement plan management to your retail investment services division can help deepen relationships across divisions in your institution, build relationships, and encourage cross-division referrals.

Target Audience: President, CEO, CFO, Directors, Financial Advisors, Commercial Loan Officers

Building a Culture that Fosters Curiosity

Target Audience: Institution Leadership, CEOs/Presidents, Human Resources Managers

Financial Health: What Millennials Want — A Strategic Imperative for Bank Leaders

Target Audience: Institution Leadership, President, CEO, Directors, Financial Advisors, Branch Managers, HR

Top 10 Areas for Leadership Development

Target Audience: Institution Leadership, President, CEO, Directors, Financial Advisors, Branch Managers, HR

Creating a Community Financial Oasis

Target Audience: President, CEO, CFO, Directors, Financial Advisors, Accountants

Own the Room, Build the Trust, Earn the Business

Target Audience: Directors, Financial Advisors, Branch Managers